Texas residents benefit from no statewide income tax.

Unlike many other states, the financial backbone of local governance comes from property taxes. These taxes play a pivotal role in funding essential services such as education, infrastructure maintenance, public safety, and various municipal amenities.

Property taxing authorities typically evaluate real estate value and levy taxes according to the property’s geographic location. This system shifts the burden of financing local services to the local property owners throughout the state.

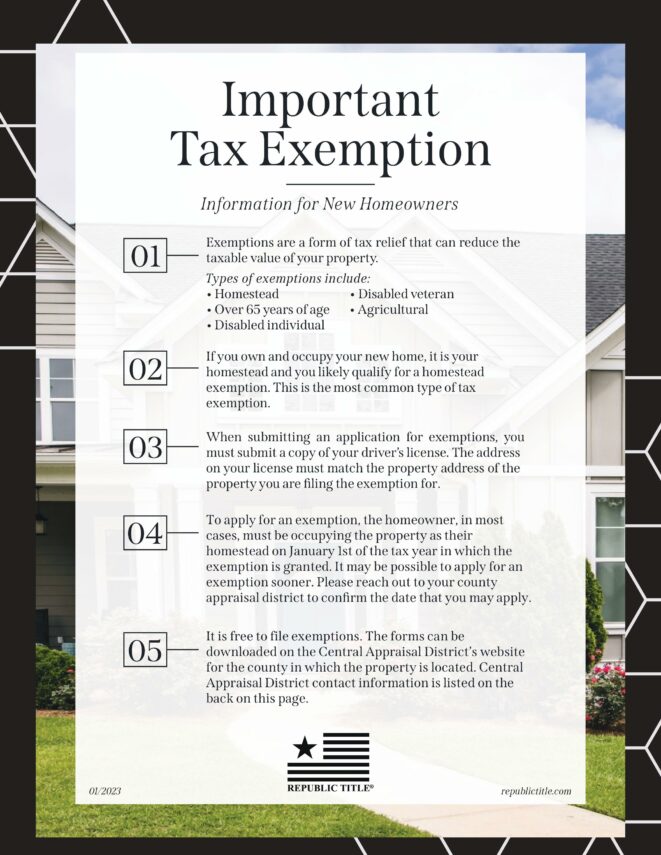

When it comes to property taxes, there are quite a few exemptions up for grabs. But one you’ll hear about a lot is the Homestead Exemption. Basically, it’s a way to lower the amount of tax you owe on your property by acknowledging that it’s your primary residence.

To qualify for homestead exemptions, you must own and reside in your home on January 1 of the tax year. You may only apply for residence homestead exemptions on one property in a tax year.

TEXAS HOMESTEAD EXEMPTION

YOU ONLY HAVE TO FILE ONE TIME AND IT’S FREE!

Find everything online to file for your Homestead Exemption – Couldn’t be easier!

SEARCH PUBLIC RECORDS BY ADDRESS & COUNTY TO FIND DETAILS & FORMS

Collin County Central Appraisal District

collincad.org | 469-742-9200

Dallas County Central Appraisal District

dallascad.org | 214-631-0520

Denton County Central Appraisal District

dentoncad.org | 940-349-3800

Ellis County Central Appraisal District

elliscad.org | 972-937-3552

Grayson County Central Appraisal District

graysonappraisal.org | 903-893-9673

Hunt County Central Appraisal District

hunt-cad.org | 903-454-3510

Johnson County Central Appraisal District

johnsoncad.com | 817-648-3000

Kaufman County Central Appraisal District

kaufman-cad.org | 972-932-6081

Parker County Central Appraisal District

parkercad.org | 817-596-0077

Rockwall County Central Appraisal District

rockwallcad.com | 972-771-2034

Tarrant County Central Appraisal District

tad.org | 817-284-0024